sold for a cool $7,000 profit

A nice gain. I'd rather bet on red at the roulette wheel. I dont or try not to day trade. I will look to short BA and TSLA or AZO here soon

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

sold for a cool $7,000 profit

This might turn out like 2008. A lot of volatility around the time of TARP/stimulus, then slowly bottoming out while the economic numbers come in before finally rebounding

My opinion, and it's just that an opinion, is that the bottom was reached in the panic selling on Monday. Always nervous when you have 2 days of no trading and people sitting at home and all they hear is that news. I think about 5-6MM job losses are factored in now. Not saying we won't go back down but I think we should have a bottom that we would bounce off of now if we do go back there.

I probably just jinxed the whole thing now.

If the bottom did hit Monday I'm going to be pissed at myself for not pulling the trigger on a few stocks then I was watching.

A nice gain. I'd rather bet on red at the roulette wheel. I dont or try not to day trade. I will look to short BA and TSLA or AZO here soon

If the bottom did hit Monday I'm going to be pissed at myself for not pulling the trigger on a few stocks then I was watching.

My opinion, and it's just that an opinion, is that the bottom was reached in the panic selling on Monday. Always nervous when you have 2 days of no trading and people sitting at home and all they hear is that news. I think about 5-6MM job losses are factored in now. Not saying we won't go back down but I think we should have a bottom that we would bounce off of now if we do go back there.

I probably just jinxed the whole thing now.

You could be right, but there’s a couple things that make me wary:

1. I don’t think we’ve seen the full effects of the recent unemployment spike and impacts to business.

2. We haven’t reached the worst part of the outbreak yet, and any subsequent consequences of more sick/dead people.

Again, it will all be obvious in hindsight

Didn't a lot of companies cancel those calls? I'm pretty sure mine did.I think the next big news from the market will come from q1 earnings calls. We'll see how much the virus affected February and March business. I think q1 numbers will disappoint leading to companies tightening their belts and slower growth leading in to q2.

Didn't a lot of companies cancel those calls? I'm pretty sure mine did.

i shorted both tesla and boeing and lost a lot.

If the bottom did hit Monday I'm going to be pissed at myself for not pulling the trigger on a few stocks then I was watching.

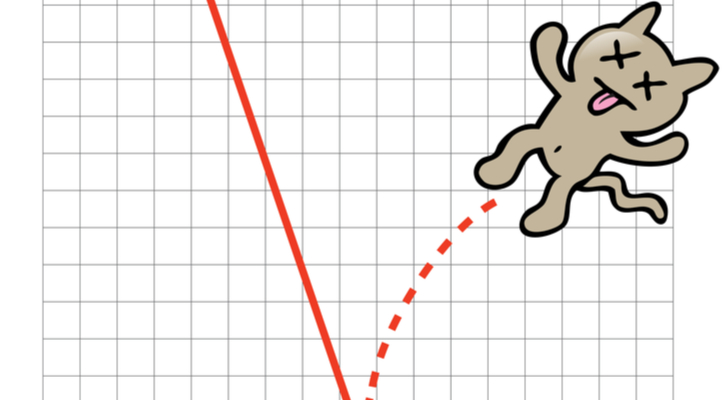

Temporary bottom. You almost Always bounce and possibly bounce hard and then grind lower and either retest or even make the final low.

A dead car is usually a 5% or so. This thing has climbed 20%.

Lol, yeah autocorrect knows better than me apparently. I hate the changes that it makes when you press post.I’d recommend AAA for dead cars

Lol, yeah autocorrect knows better than me apparently. I hate the changes that it makes when you press post.